mississippi state income tax phone number

The state income tax rate is displayed on the Massachusetts Form 1 and can also be found inside the Massachusetts Form 1 instructions booklet. The state income tax rate is displayed on the Michigan 1040 form and can also be found inside the Michigan 1040 instructions booklet.

Which U S States Have The Lowest Income Taxes

The Michigan 1040 instructions and the most commonly filed individual income tax forms are listed below on this page.

. Effective July 1 2018 businesses located out of the state that have sales into the state of Mississippi that exceed 250000 over any twelve month period are considered to have substantial economic presence in the state and are required to register with the Mississippi Department of Revenue in order to collect and remit tax. Kentucky supports both electronic filing and payments by phone. You may check the status of your refund on-line at Massachusetts Tax CenterYou can start checking on the status of your return within 24 hours after we have received your e-filed return or 4 weeks after you mail a paper return.

New York 159 percent of state income Connecticut 154 percent and Hawaii 141 percent. Join our Mialing List. The Michigan income tax rate for tax year 2021 is 425.

Printable Massachusetts state tax forms for the 2021 tax year will be based on income earned between January 1 2021 through December 31 2021. By contrast the median state-local tax burden is 102 percent and the national average is 116 percent. The Magnolia State now effectively exempts the first 5000 of taxable income while assessing a 4 percent tax on the next 5000 and a 5 percent tax on all taxable income above 5000.

The residents of three states stand above the rest experiencing the highest state-local tax burdens in the country. To e-file your Kentucky and Federal income tax returns you need a piece of tax software. Mississippi State Personnel Board.

Suite 800 Jackson Mississippi 39201 Phone 601 359-1406 Fax 601 488-2903. Free income tax efiling is available for may taxpayers. Input your social security number or the primarys social security number in the case of a joint account and create a PIN number by clicking on the Dont have a PIN link next to the log in screens PIN field.

The Massachusetts income tax rate for tax year 2021 is 5. Massachusetts Department of Revenue issues most refunds within 21 business days. The Mississippi State Personnel Board is the human resources management agency for State government and we are committed to ensuring a quality workforce for the State of Mississippi.

Taxpayer has certain recourse if aggrieved. Records and federal and state income tax returns by the tax administrator. To check on your Kentucky tax refund you can call the refund hotline at 502 564-1600 please note this number is not toll-free.

159 enacted on May 6 2021 Montanas top marginal individual income tax rate was reduced from 69 to 675 percent on January 1 2022.

Tax Refunds 2022 Why Did You Only Get Half Of Your Tax Return Marca

Repeal Prwora Project Social Security Tax Vs Old Age Retirement Income Wholedude Whole Planet Social Security Benefits Social Security Map

A New Report Analyzes How Each State Taxes Or Does Not Tax Social Security Income Social Security Benefits State Tax Social Security

Pin By Ms Lynn On Dol Ga Phone Numbers Fails Governor

Financial Literacy For Educators And Other Professionals 5 Refreshing Ways To Spend Your Tax Refund Tax Refund Financial Literacy Personal Financial Literacy

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

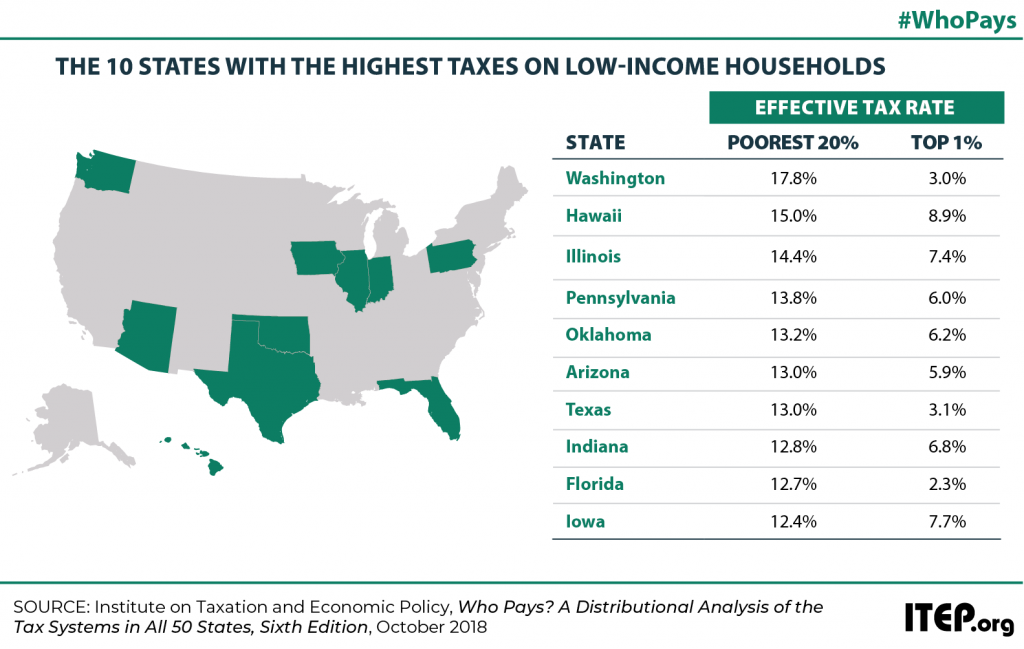

Low Tax States Are Often High Tax For The Poor Itep

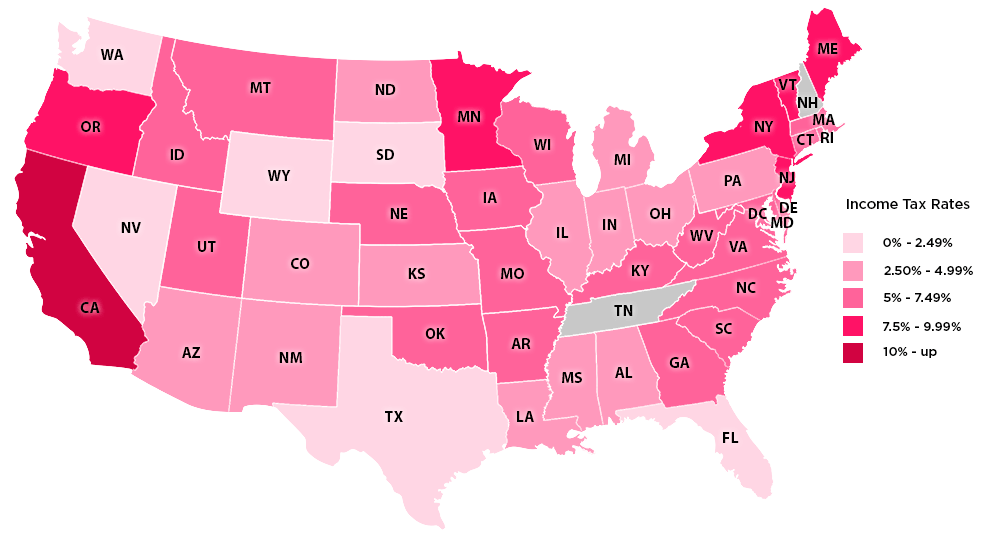

The Most And Least Tax Friendly Us States

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

How Do State And Local Individual Income Taxes Work Tax Policy Center

Alabama Tax Rates Rankings Alabama Taxes Tax Foundation

Top Income Tax Rate By State States With No Income Tax 1 Alaska 2 Florida 3 Nevada 4 South Dakota 5 T Retirement Retirement Income Retirement Locations

State Income Tax Rates Highest Lowest 2021 Changes

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

Is Living In A State With No Income Tax Better Or Worse Bankrate Income Tax Income Tax

37 States Don T Tax Your Social Security Benefits Make That 38 In 2022 Marketwatch Social Security Benefits Social Security State Tax

Alabama Tax Rates Rankings Alabama Taxes Tax Foundation

State Corporate Income Tax Rates And Brackets Tax Foundation