open end lease accounting

Download the Free version of NetLease Go Free for NetSuite users. The accounting for an operating lease assumes that the lessor owns the leased asset and the lessee has obtained the use of the underlying asset only for a fixed period of.

Accounting For Leases The Marquee Group

A lease in which the lessee guarantees the lessor the difference between the residual value of the leased asset and the value realized from the assets sale at lease termination is an open-end.

. In this blog we will provide a comprehensive example of operating lease. New Guidance in Accounting for and Reporting Leases. Ad Tell Us What You Need and Get Matched to Top Rated Local Accountants Free.

Open-end leases are generally blanket or master leases with multiple takedowns of equipment. Get Products For Your Accounting Software Needs. When you lease a car youll usually be offered a closed-end lease.

Free AR Team to Focus on Value-Added Activities. We Provide All the Info You Need to Choose the Right Lease Accounting Solution Provider. 100s of Top Rated Local Professionals Waiting to Help You Today.

The Top 15 Questions to Ask when Comparing Lease Accounting Software. Outsource CAM audit services prevent overcharges minimize risk of slippage. In a Nutshell.

A lease is an arrangement under which a lessor agrees to allow a lessee to control the use of identified property plant and equipment for a stated period of time in exchange for. Ad Reduce Manual Activity by 85. Open-end leases are pervasive in fleet leasing because they offer fleet managers greater control of asset utilization and disposal.

By now you may have heard about the Governmental Accounting Standards Board Statement Number GASB 87. Read more at the end of useful life is nil. A companyemployer will assume management and leasing of the car to its.

O Contact legal counsel and explain the new terms for accounting purposes. Your total cost of ownership isnt known until the vehicle is remarketed. Closed-End Leases Comparison Sale Leaseback Programs New Lease Accounting Rules 9 Factors to Consider When Choosing a.

We Provide All the Info You Need to Choose the Right Lease Accounting Solution Provider. An open-end lease has more flexible terms and the lessee takes on the depreciation risk of the asset. In a closed-end lease the lessor takes on the depreciation risk.

They normally involve portable or mobile equipment that is. Lease accounting may drive a fleets decision to steer away from a closed-end lease because the right to use an asset would be required for the entire lease term. Ensure Lease Accounting Compliance with Visual Leases Lease Accounting Software.

The open-end finance lease which in most cases has either an addendum or a modification to the contract changing it to an operating lease for accounting purposes. Short-term leases contract term is for twelve months or less including options to extend will continue to be. Ad Get Complete Accounting Products From QuickBooks.

For example if a companys machinery has a 5-year life and is only valued 5000 at the end of that time the salvage value is 5000. Let us take the example of a company that has entered into an operating lease agreement for an asset and has agreed to a rental payment of 12000 for a period of twelve. The Top 15 Questions to Ask when Comparing Lease Accounting Software.

Us Leases ASC 840 ARM 465058. An open-end lease is when you take on the vehicles depreciation risk. The new lease accounting standards are significantly changing the accounting for operating leases.

Lets walk through a lease accounting example. In a closed-end lease the leasing company takes on the risk of any additional depreciation. There are many advantages to an Open-End Lease such as.

Author markus Posted on Categories Leasing FAQs Tags closed end lease calculator closed end lease definition difference between open end and closed end car lease fixed cost lease open. Annual payments are 28500 to be made at the. An open-end lease is a type of rental agreement that obliges the lessee the person making periodic lease payments to make a balloon payment at the end of the lease agreement amounting to t.

Ad Leverage professional CAM audit services to ensure accuracy of charges maximum recovery. Open-end leases also exist and are most often used in the case of commercial business lending. Ad Simplify automate processes from lease compliance to advanced fixed asset management.

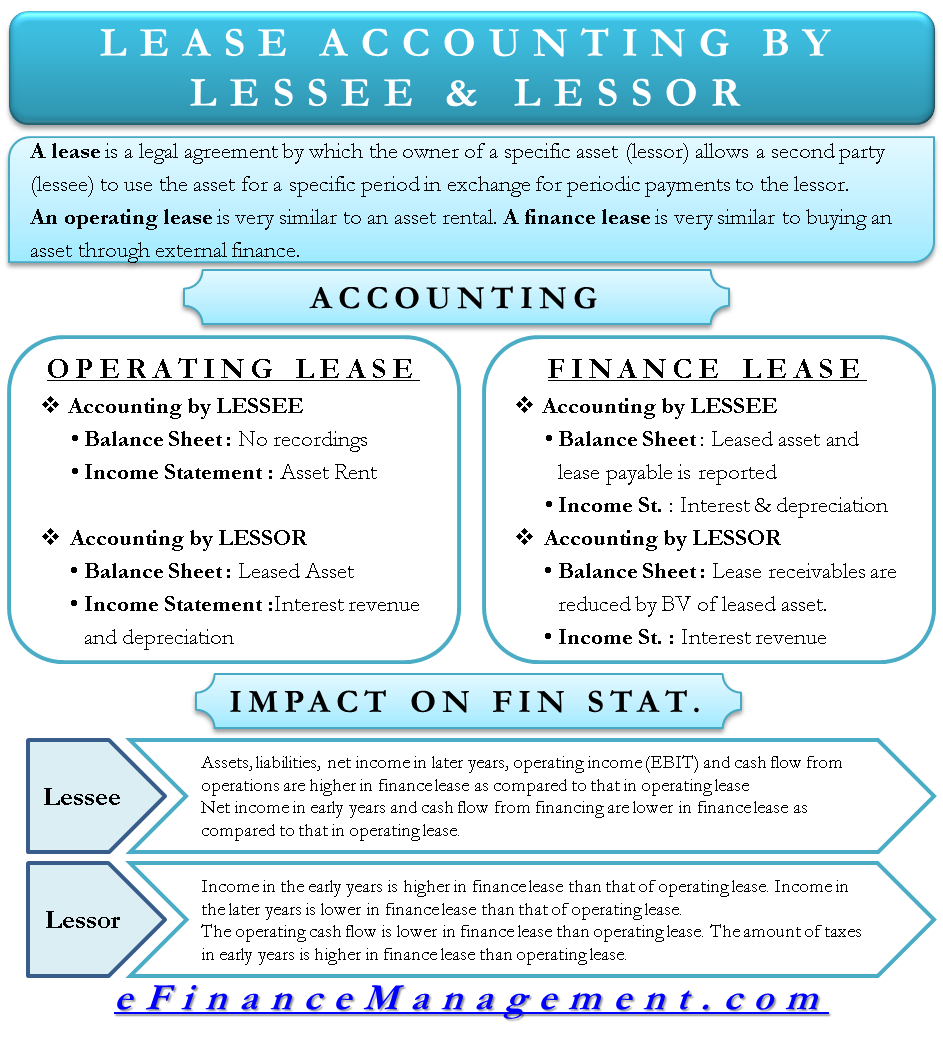

Open-End Leases Closed-End Leases Open-End Leases vs. A lease is a legal agreement by which the owner of a specific asset lessor allows a second party lessee to use the asset for a specific period in exchange for periodic. The structure of an open-end lease.

Ad Manage Your Entire Lease Portfolio And Stay Compliant With Lease Accounting Software. On the open-end lease the lessee will use up and pay off a great percentage of those vehicles useful lives so their residual values at end of term are less of a factor. Learn about BlackLines AI-Powered Solutions for Accounts Receivable.

In an open-end lease you may receive a refund of any gain and you are responsible for any deficiency. On January 1 2017 XYZ Company signed an 8-year lease agreement for equipment. For example if your lease early termination payoff is 16000.

Acquiring the needed assets without paying the full costs up front and keeping lines of credit available Various payment types.

Practical Illustrations Of The New Leasing Standard For Lessees The Cpa Journal

Lessee Accounting For Governments An In Depth Look Journal Of Accountancy

Practical Illustrations Of The New Leasing Standard For Lessees The Cpa Journal

Open Vs Closed End Leases What To Know Credit Karma

Lease Accounting Calculations And Changes Netsuite

Lease Accounting Operating Vs Financing Leases Examples

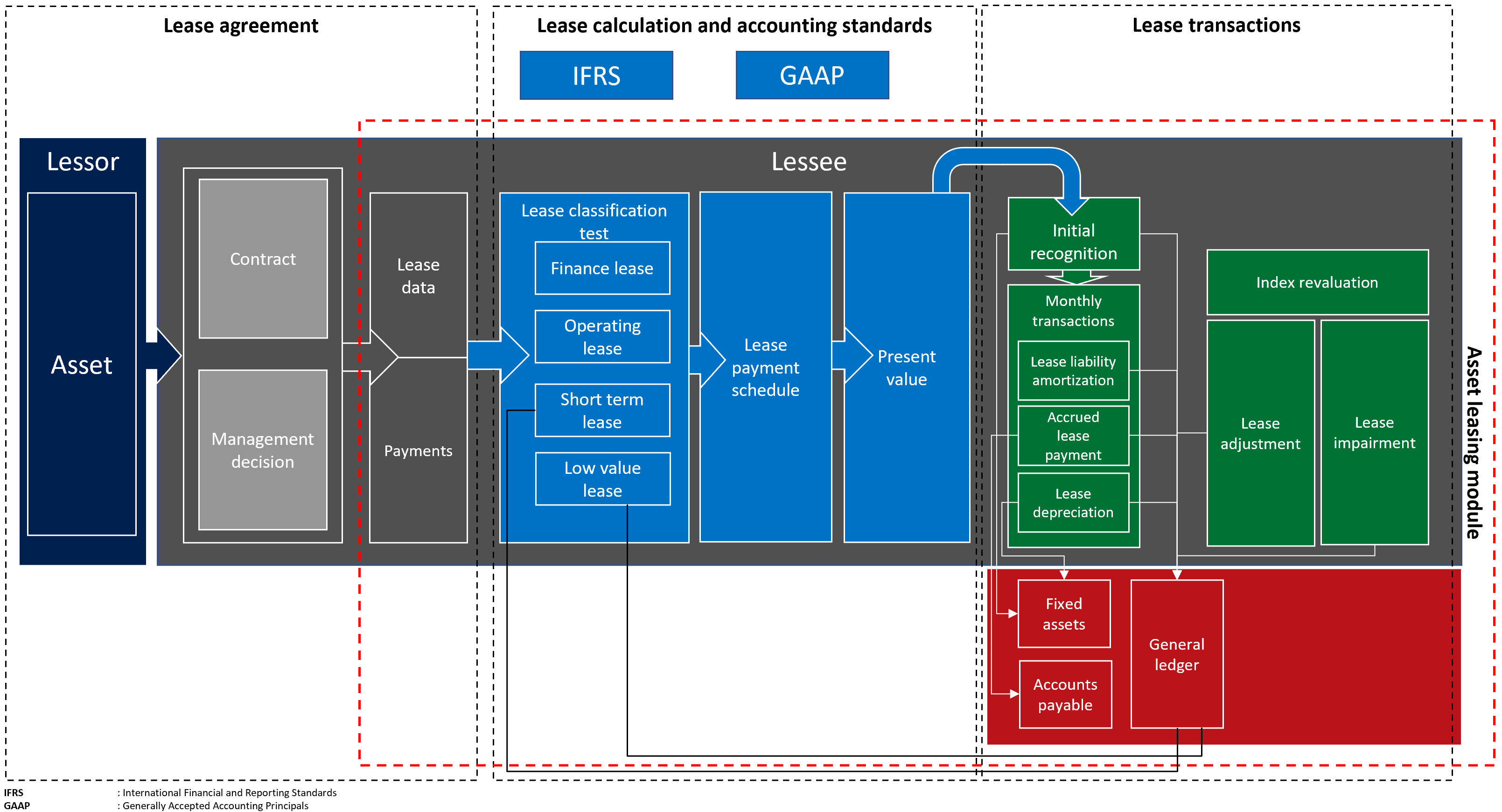

Asset Leasing Get Started Finance Dynamics 365 Microsoft Docs

Lease Accounting Treatment By Lessee Lessor Books Ifrs Us Gaap

How To Calculate The Journal Entries For An Operating Lease Under Asc 842

Lessee Accounting For Governments An In Depth Look Journal Of Accountancy

Asc 842 Lease Accounting Budget Planning Finance Lease Public Company

-A-Guide-for-Tech-Com/Tech_Lease-Accounting-Guide_brochure_10-18_webcharts1.png.aspx)

Lease Accounting A Guide For Tech Companies Bdo Insights

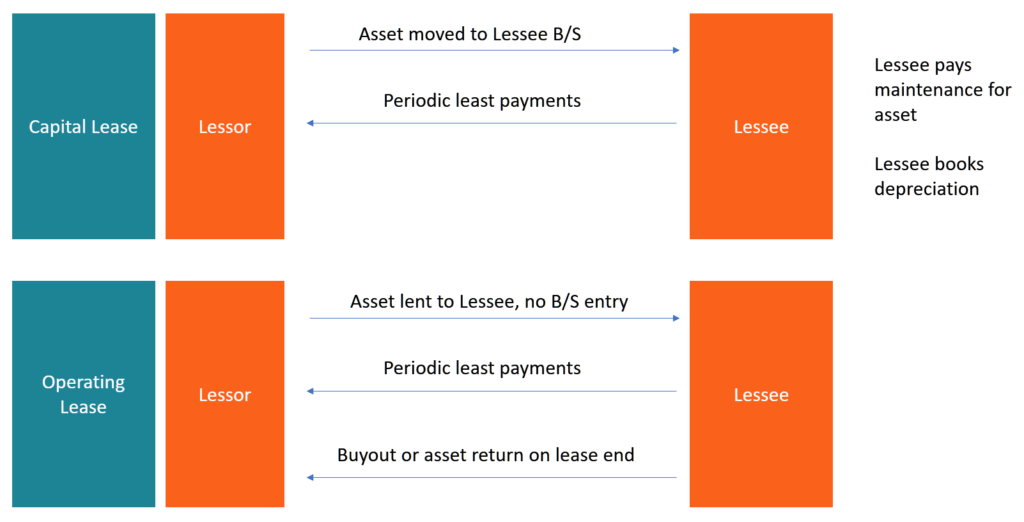

Capital Lease Vs Operating Lease What You Need To Know

Lessee Accounting For Governments An In Depth Look Journal Of Accountancy

Lessee Accounting For Governments An In Depth Look Journal Of Accountancy

:max_bytes(150000):strip_icc()/GettyImages-912785590-bd21254b8f914ad1a28876e45800554c.jpg)

/GettyImages-1149107425-99d2c7fcb6264e13bb34f7746eeabb0d.jpg)